Overcoming the Challenge of Remote Risk Assessment for Commercial and Industrial Sites

Brokers and insurers often face a common challenge when assessing risk for commercial or industrial properties: collecting accurate data on-site without physically sending people to every location. Large commercial parks and industrial sites, in particular, present unique hurdles due to incomplete address information, inaccurate geolocation data, or inconsistencies in third-party data sources. These issues make it difficult to pinpoint exact building locations and collect the necessary data for proper risk assessment, especially when managing a global portfolio.

Why Is This a Challenge?

One of the key challenges in remote risk assessment is the inability to resolve exact building locations within large commercial or industrial sites. An address might lead to the general area but not pinpoint a specific building or unit. This becomes even more complex when dealing with global portfolios, as third-party data services for building and parcel data often have limited geographic coverage, offering detailed information only in select regions. For brokers and insurers aiming to assess risk comprehensively, this lack of precision hampers their ability to make informed decisions.

The Objective: Collecting Meaningful Risk Insights Remotely

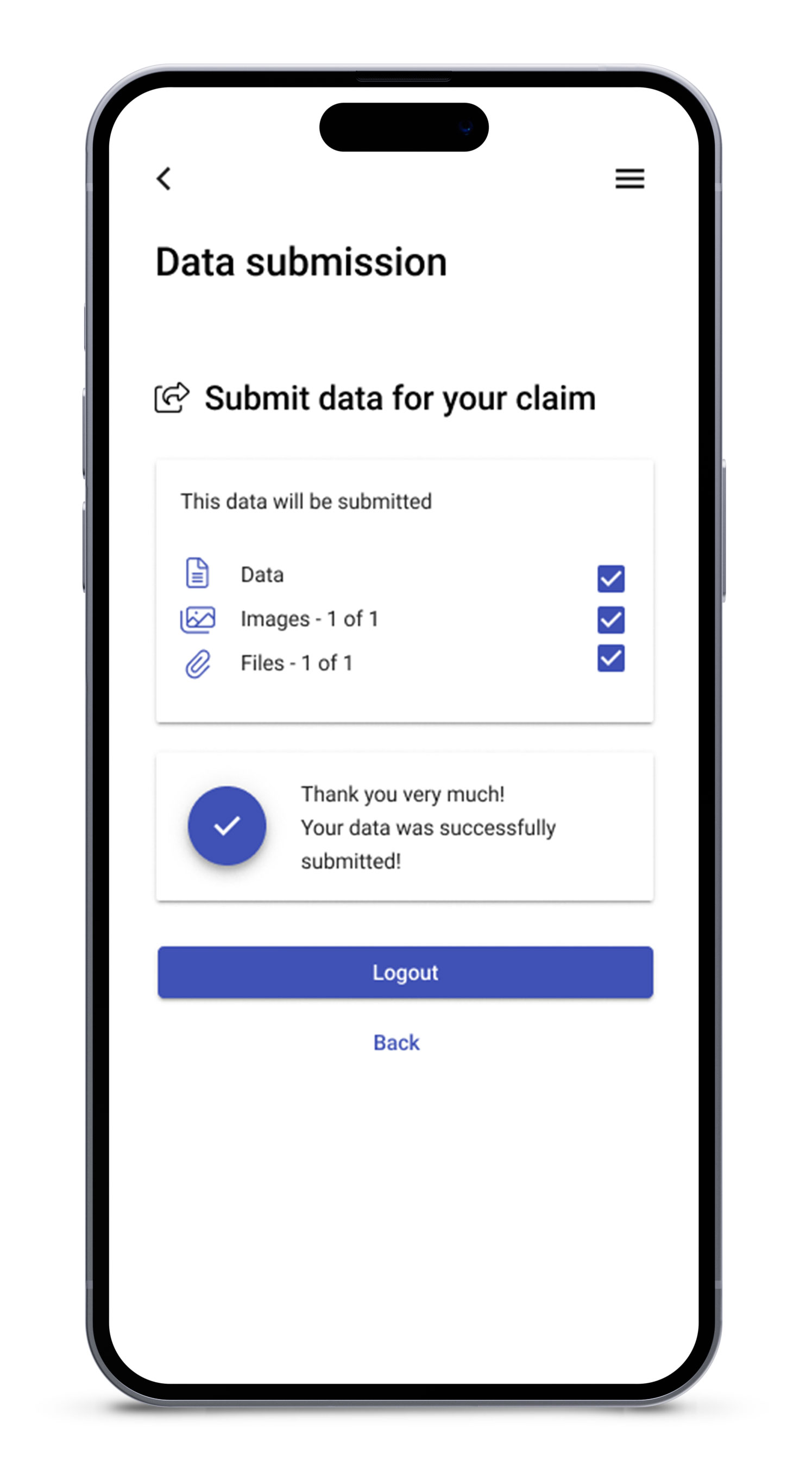

To enable proper risk assessment and effective mitigation strategies, it’s essential to gather a robust set of data points for each building – without relying on costly, in-person inspections. The objective is to collect the right information remotely, allowing brokers and insurers to assess the risks associated with each property more accurately. This approach not only saves time and resources but also ensures that a consistent and reliable data collection method is in place for global operations.

Start Small, Think Big

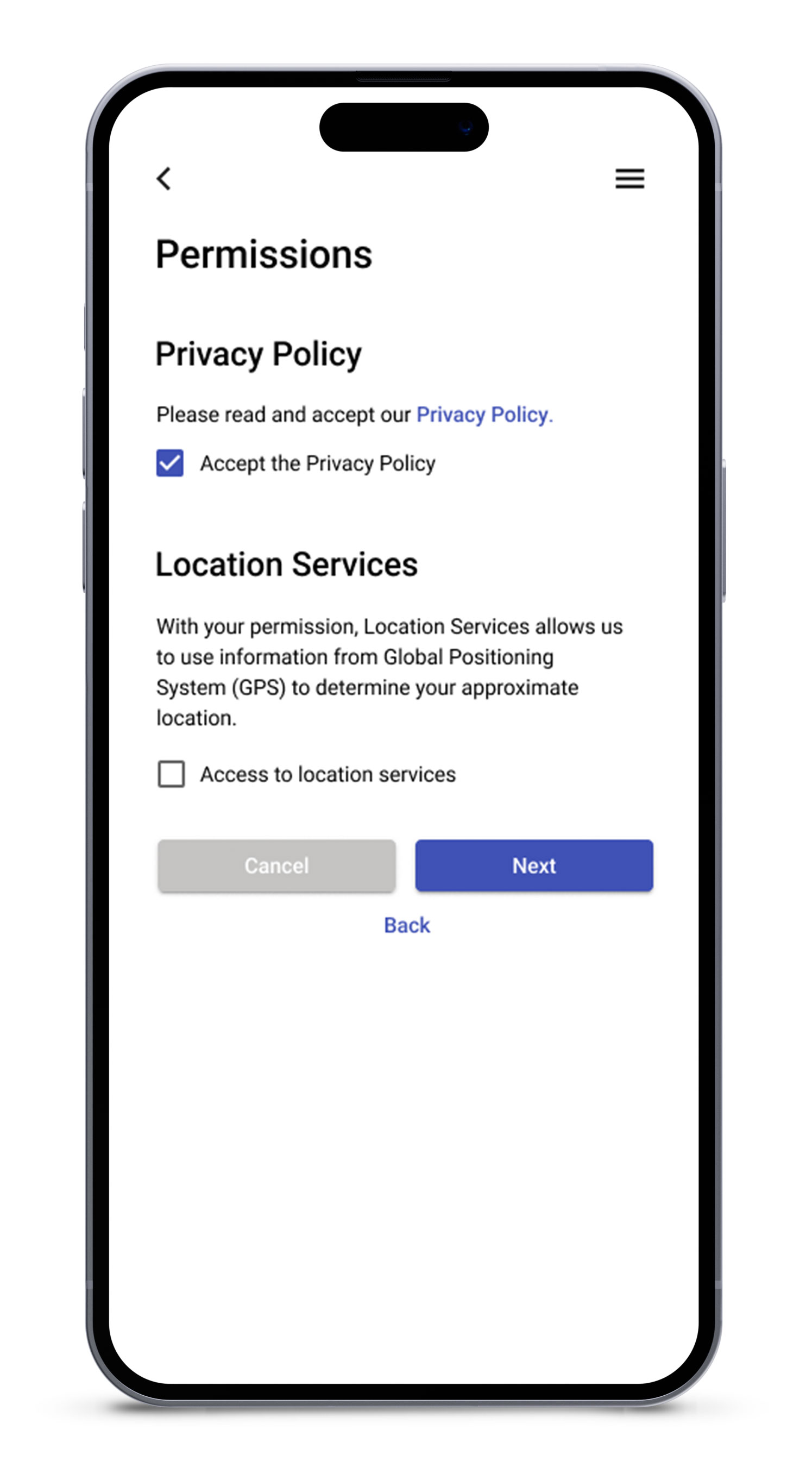

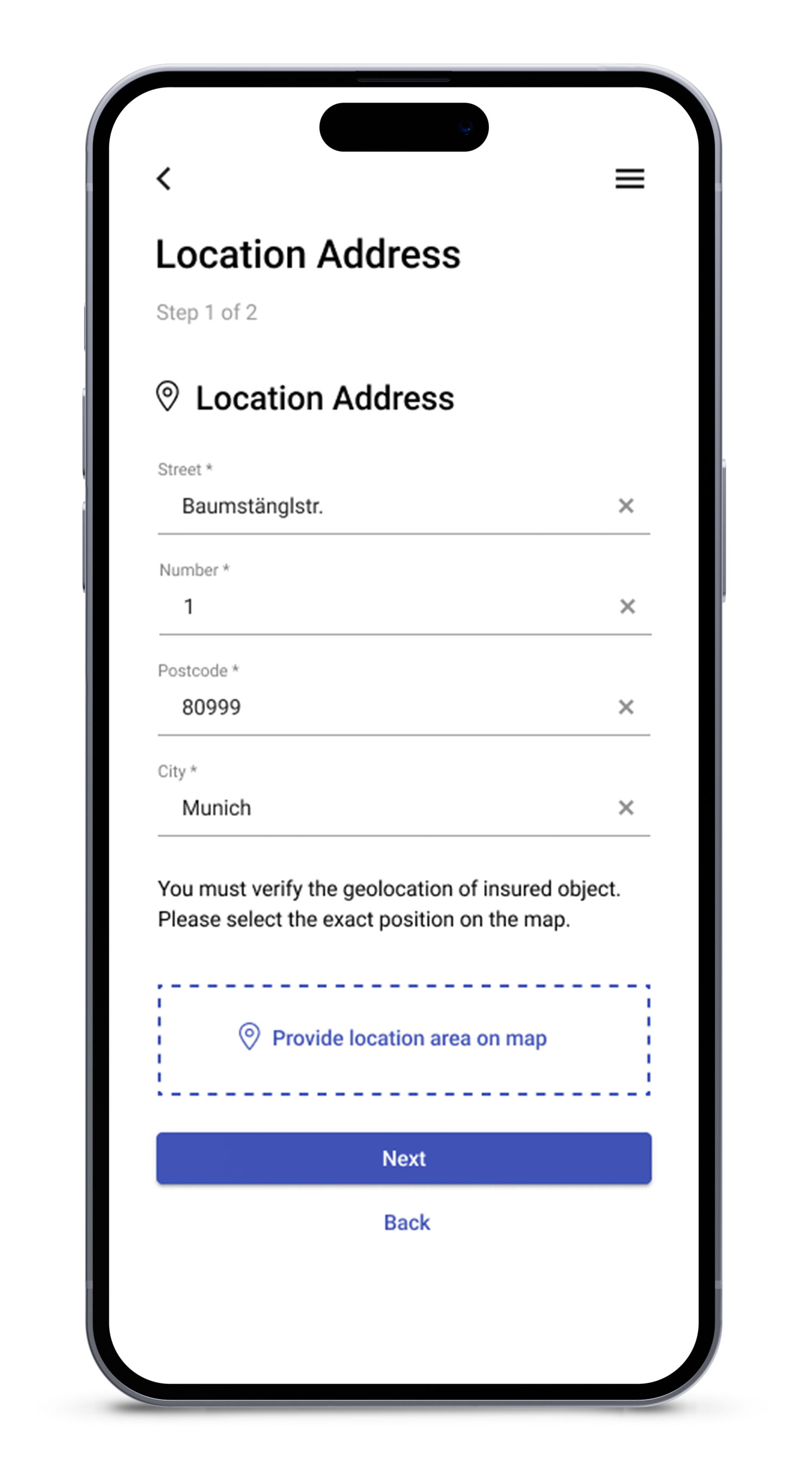

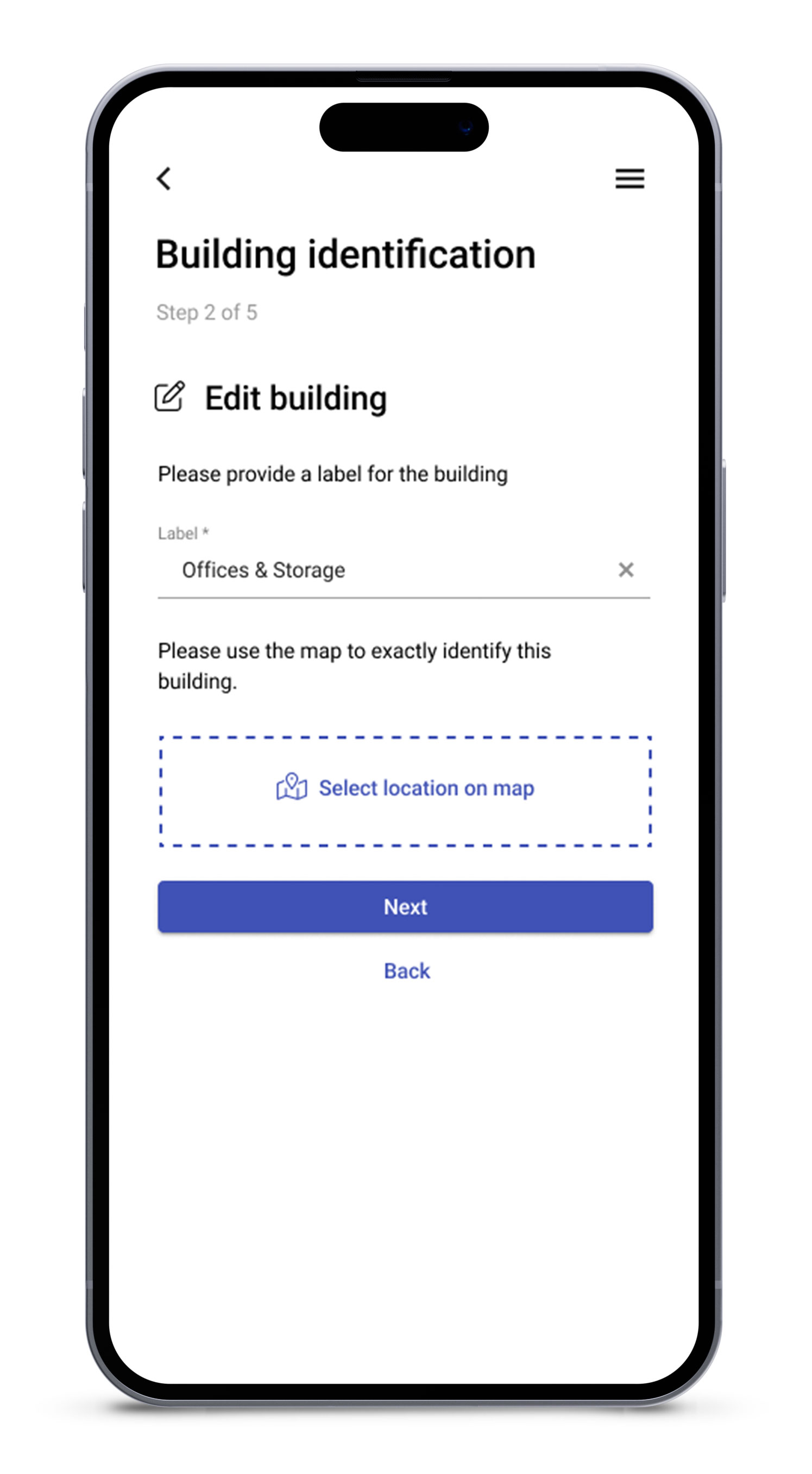

The key to successfully tackling this challenge is starting with clear goals in mind. Begin small by focusing on the essential data points you need to gather upfront, and gradually expand as the system evolves. For example, the initial data collection can start with a simple, self-service workflow where someone already onsite – such as a property manager or employee – uses a smartphone to capture key information. This might include the building’s geolocation data, a few photographs of the exterior, and some basic details about the structure.

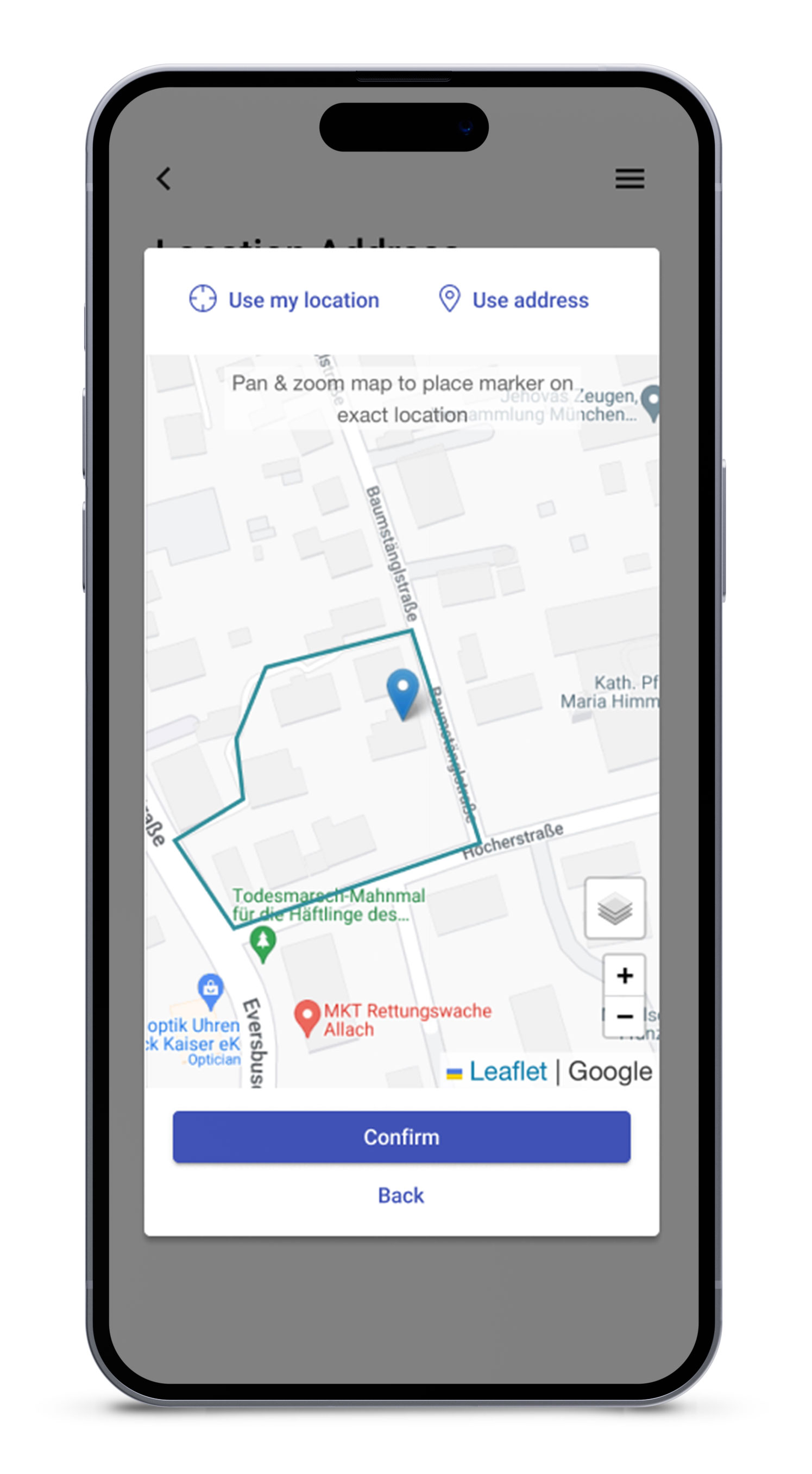

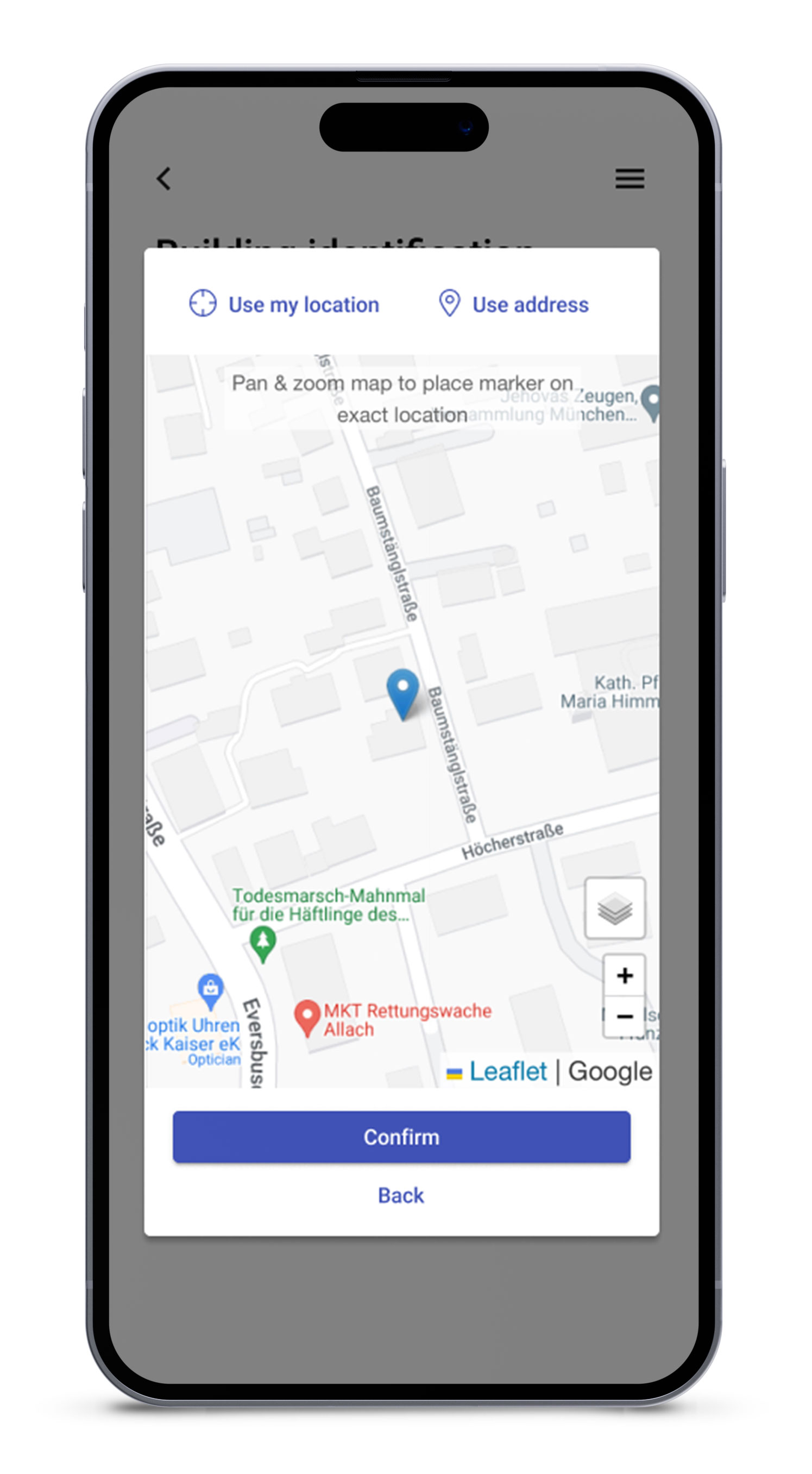

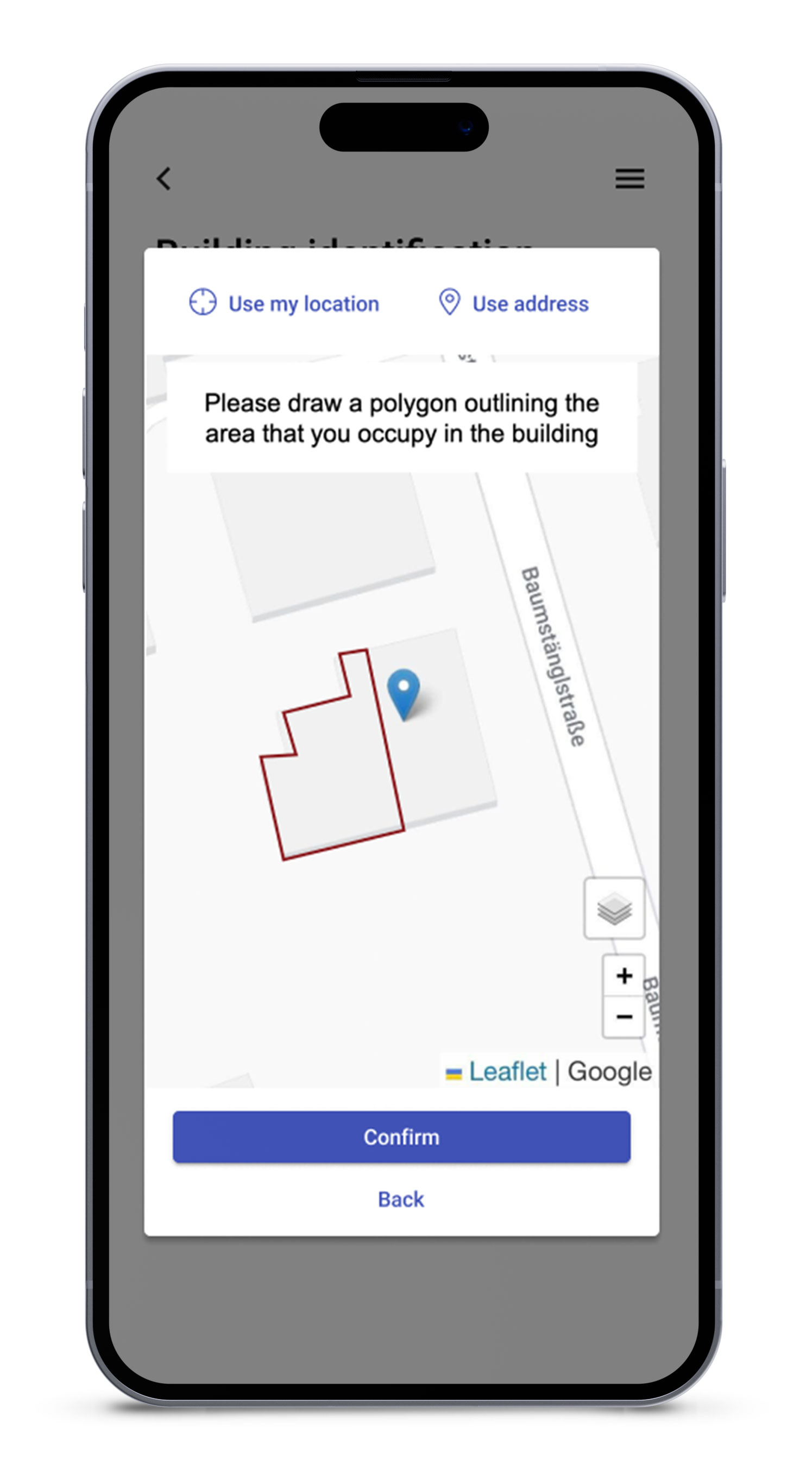

Leveraging Geolocation, Maps, and Imagery

One of the most effective ways to improve the accuracy of remote data collection is by integrating geolocation and mapping tools. As someone onsite provides the location information, the system can automatically correct and validate latitude and longitude coordinates using background maps and satellite imagery. This helps to ensure that the correct building is being assessed, even in cases where the address data is incomplete or incorrect. By visually identifying the building extent on a map, insurers can more confidently move forward with risk assessments.

Enhancing Data Collection with Third-Party Sources

Where available, third-party building and parcel data can also be integrated into the workflow, filling in gaps and enhancing the quality of the collected information. These external data sources can provide additional context on building dimensions, construction materials, or historical use, which can be crucial for a thorough risk analysis. By combining multiple data sources, the accuracy and completeness of risk assessments improve, allowing insurers to make more informed decisions.

Laying the Groundwork for Automation and Advanced Technologies

One of the most effective ways to improve the accuracy of remote data collection is by integrating geolocation and mapping tools. As someone onsite provides the location information, the system can automatically correct and validate latitude and longitude coordinates using background maps and satellite imagery. This helps to ensure that the correct building is being assessed, even in cases where the address data is incomplete or incorrect. By visually identifying the building extent on a map, insurers can more confidently move forward with risk assessments.

Enhancing Data Collection with Third-Party Sources

Where available, third-party building and parcel data can also be integrated into the workflow, filling in gaps and enhancing the quality of the collected information. These external data sources can provide additional context on building dimensions, construction materials, or historical use, which can be crucial for a thorough risk analysis. By combining multiple data sources, the accuracy and completeness of risk assessments improve, allowing insurers to make more informed decisions.

Better Risk Management Through Continuous Data Updates

As the process matures, it’s important to build on the initial data collection by adding new insights on a yearly basis. With digital workflows that make it easy for on-site personnel to provide updated information, insurers can continuously expand their risk database. Features like drop-down menus for selecting relevant answers, automated geolocation tracking, photo submissions, and even OCR (Optical Character Recognition) to extract data from devices and labels can streamline this process.

Over time, this iterative approach allows insurers to gather more detailed and comprehensive data on each location, enabling better risk management and reducing the need for repeated onsite inspections.

Learning and Adapting for the Future

No two sites are exactly the same, and neither are the requirements for risk assessment. By continuously collecting data and learning from what works and what doesn’t, insurers can flexibly adjust their approach for new locations or future rounds of data collection at existing sites. This adaptable model ensures that the data collection process remains efficient, scalable, and relevant, no matter how global or complex the portfolio becomes.

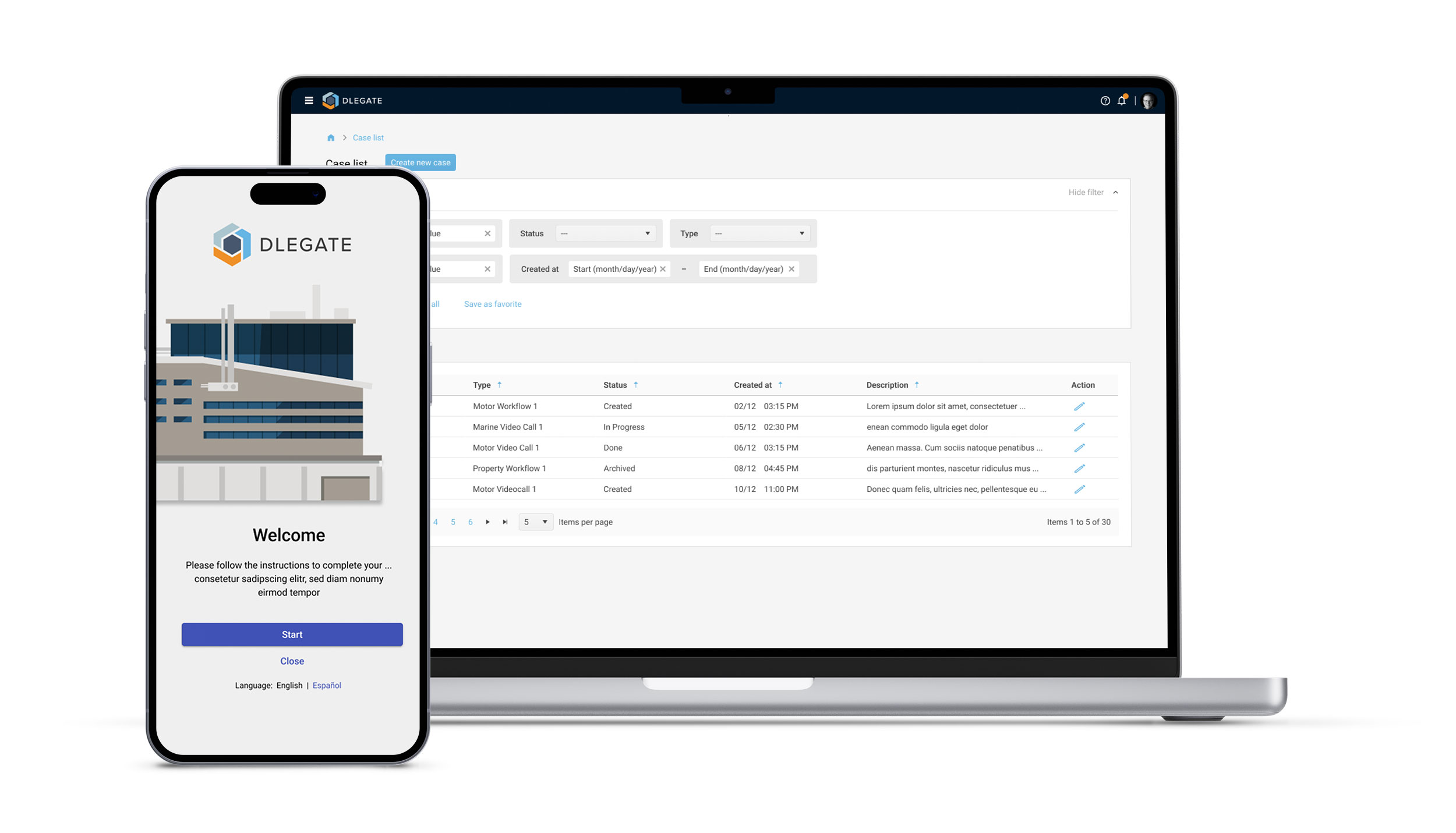

DLEGATE: Your Partner in Digital Transformation

DLEGATE supports insurers and brokers in breaking down complex challenges like remote risk assessment into manageable steps. We help clients start small, with simple workflows for collecting critical data points, and progressively build up to more advanced processes. Whether it’s integrating geolocation tools, third-party data, or automated workflows, DLEGATE partners with clients to ensure their journey toward digital transformation is smooth, scalable, and tailored to their unique needs.