Streamlining Motor Claims:

A Step-by-Step Journey with DLEGATE

As digital convenience becomes a standard expectation, insurers are increasingly exploring ways to streamline motor claims processing and enhance customer experiences. The challenge lies in ensuring that the claims process – especially at the interface with policyholders – meets these evolving expectations. Conversations with insurers now focus on transforming claims workflows, moving towards automation in multiple steps.

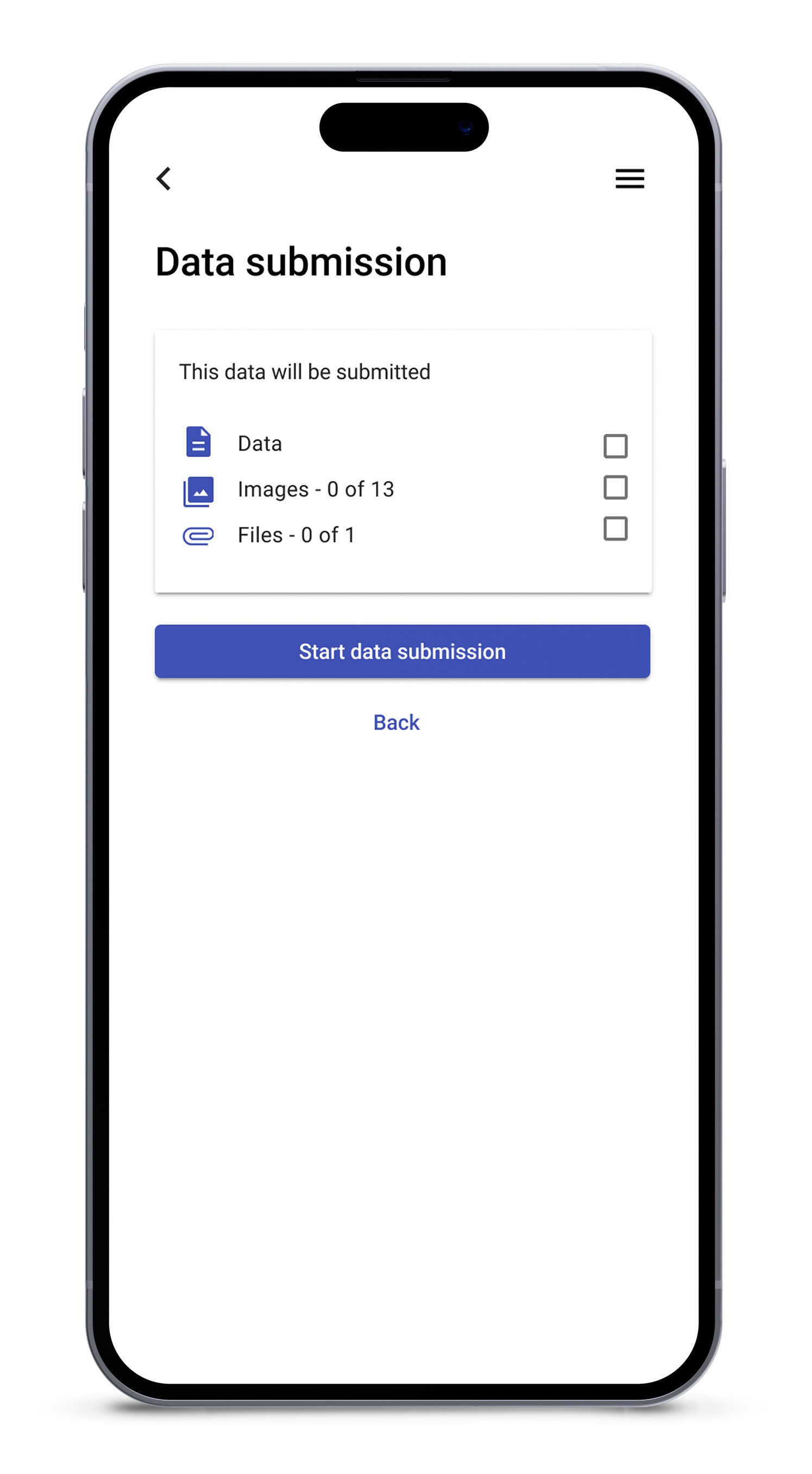

Enhancing the Data Intake Process with Self-Service Tools

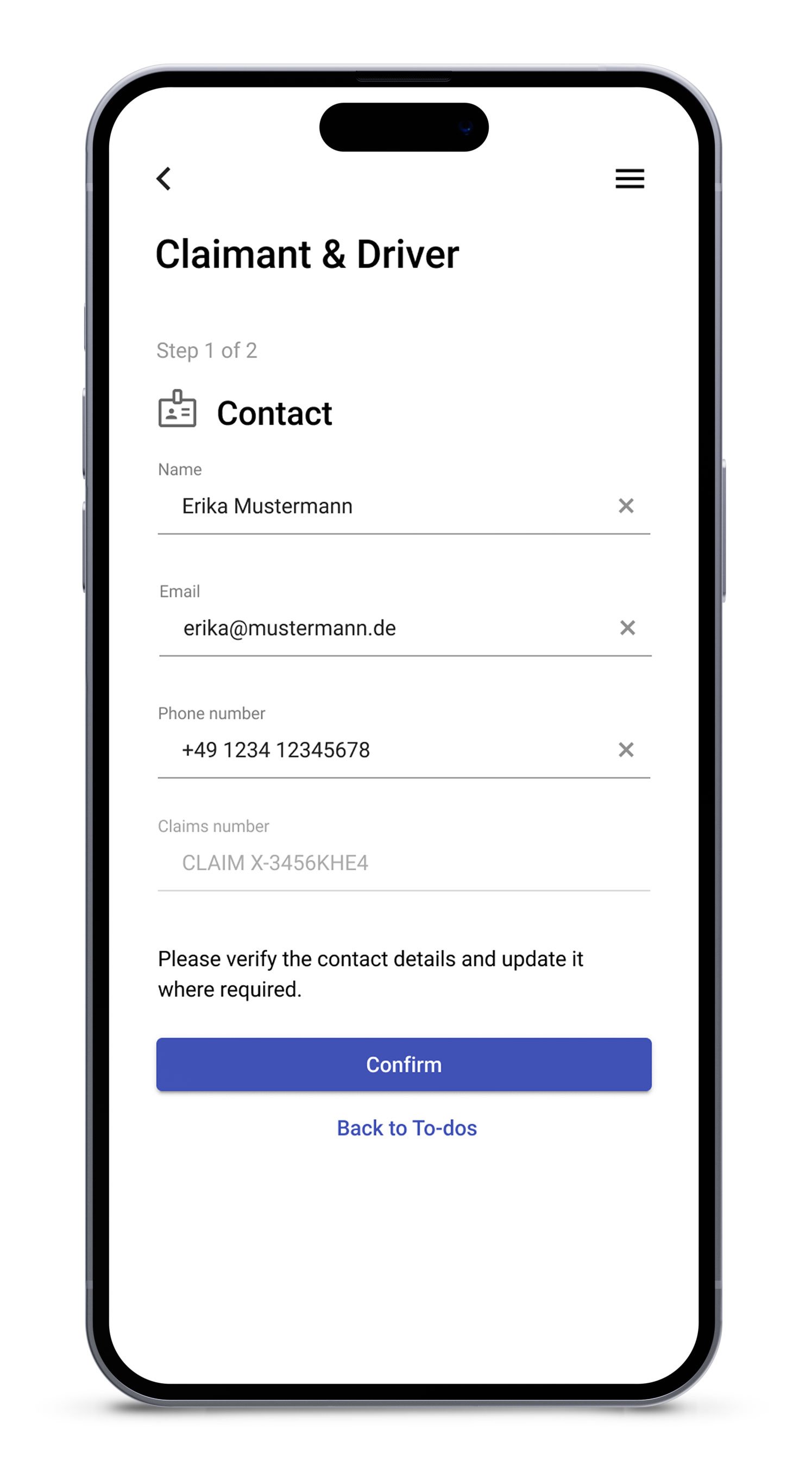

At the initial stages, insurers are exploring how digital workflows can enhance the data intake process, enabling policyholders to submit relevant claim information through intuitive, self-service tools. For instance, modern workflows allow policyholders to provide details and documentation for motor claims directly from their mobile devices, at their own convenience. As insurers evaluate their current processes, the discussion centers around how technology can gradually improve efficiency, starting from manual data collection and progressively moving towards higher automation.

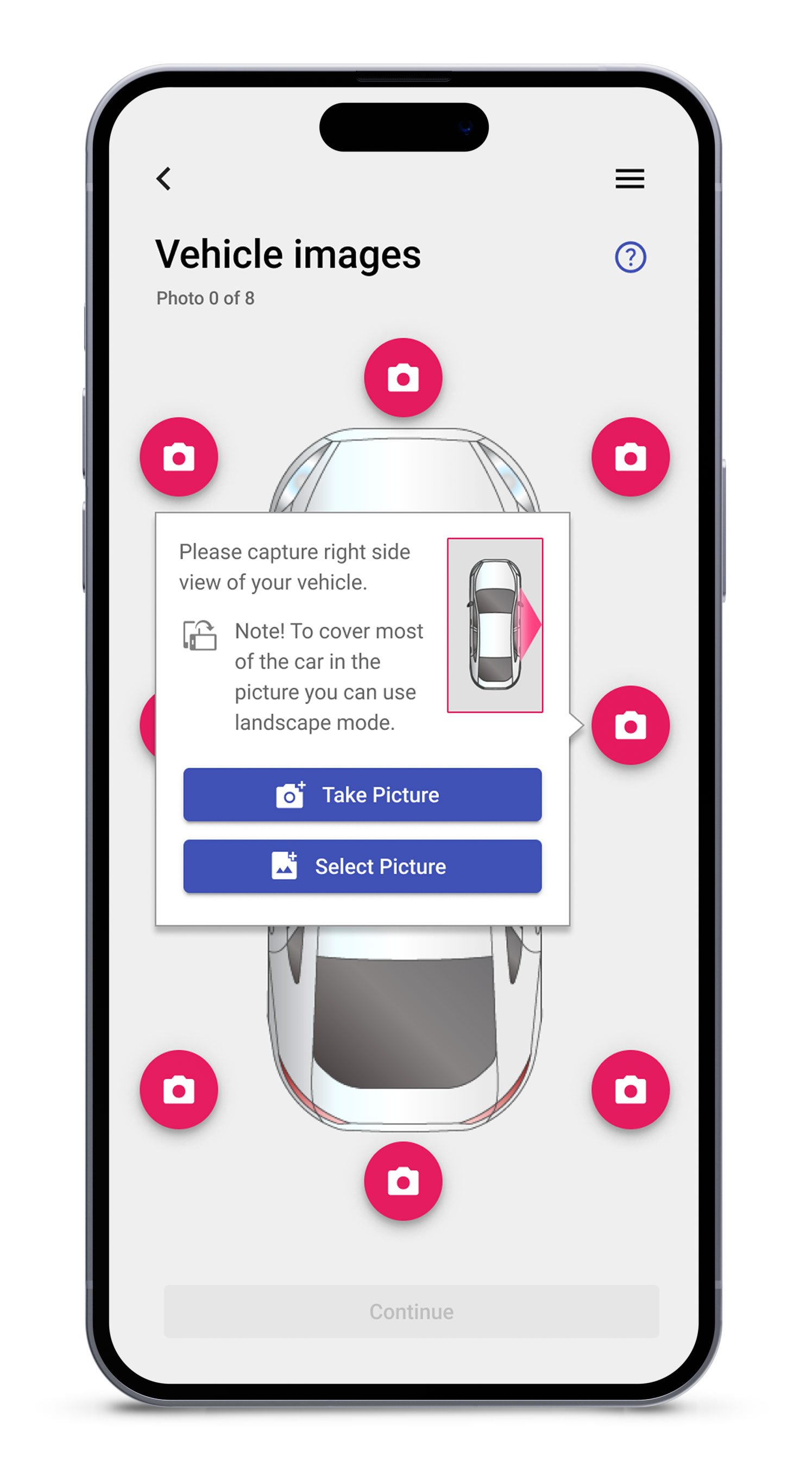

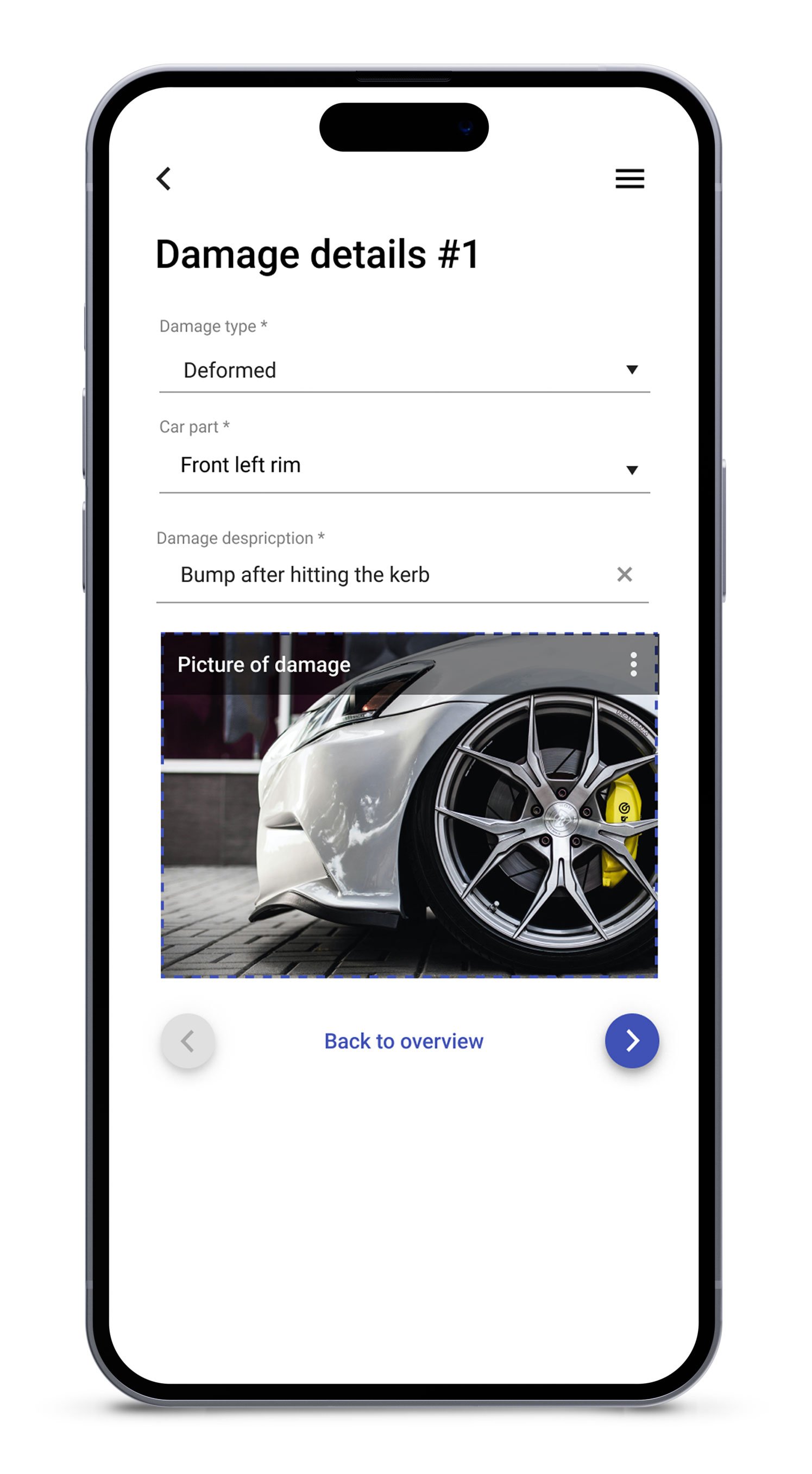

Browser-Based Workflows: A First Step Towards Automation

One key step in this journey is the shift to fully browser-based workflows that eliminate the need for additional apps. By enabling policyholders to submit driver, vehicle, and damage information, including detailed images, through guided, user-friendly interfaces, insurers can begin to collect more structured and complete datasets. Over time, such innovations set the stage for further advancements, such as the integration of pre-filled data fields, automated damage assessment, and AI-driven processing.

Moving Towards Full Automation and System Integration

The ultimate goal is a seamless, automated claims intake that not only improves processing times but also enhances data accuracy. Each phase – from data submission to integration with core systems – can be progressively refined with emerging technologies, such as AI and machine learning, further transforming the process. As the journey continues, insurers are also exploring opportunities to leverage APIs and connectors to fully integrate these workflows into their existing systems, reducing manual intervention.

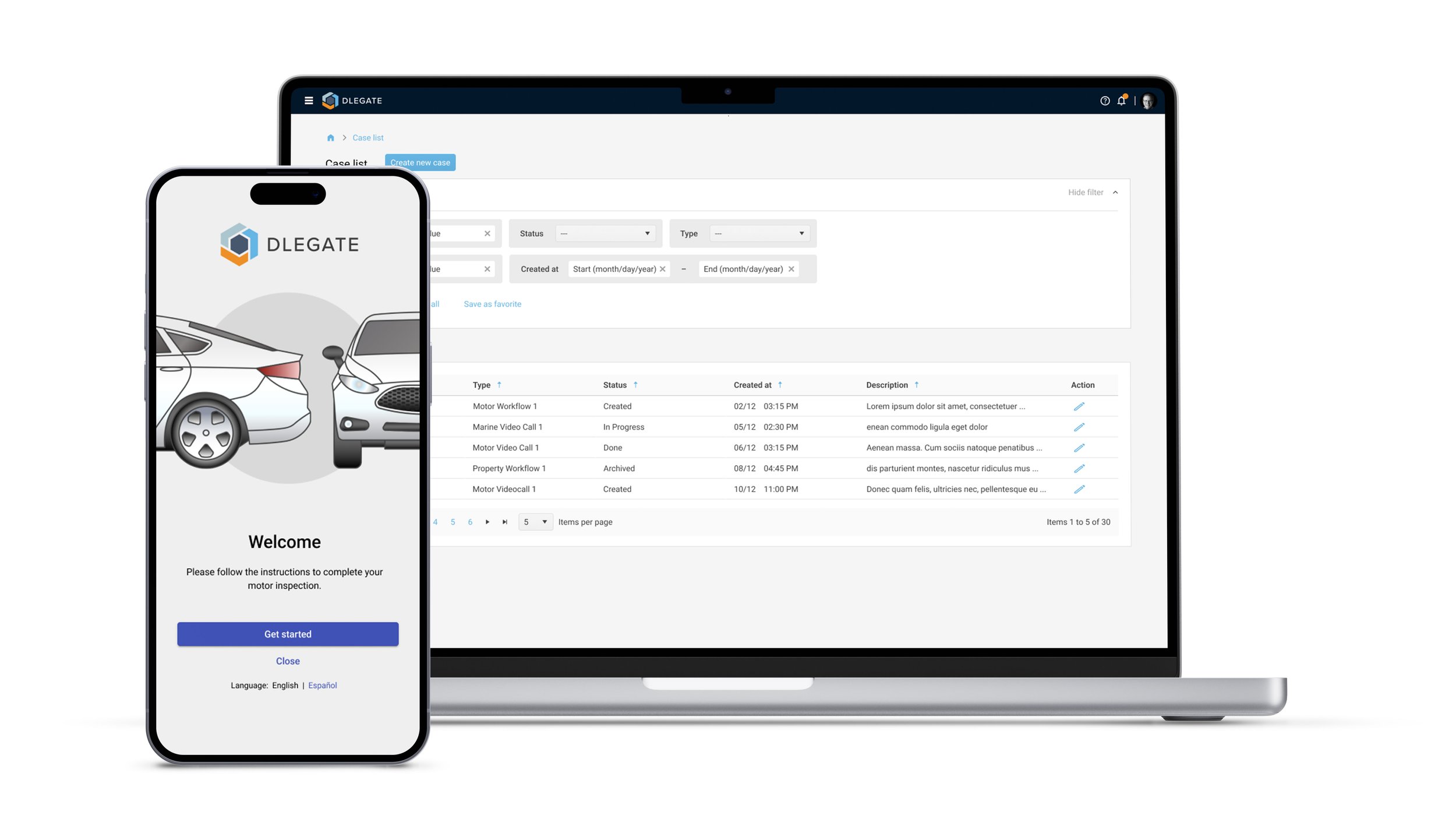

DLEGATE’s Role in Driving Transformation

DLEGATE supports insurers throughout this transformation by breaking down the complex use case of claims automation into digestible steps, both in terms of process and technology. We work closely with clients to guide them through each stage – from conceptualization to implementation – ensuring a smooth transition to digital, automated claims handling.